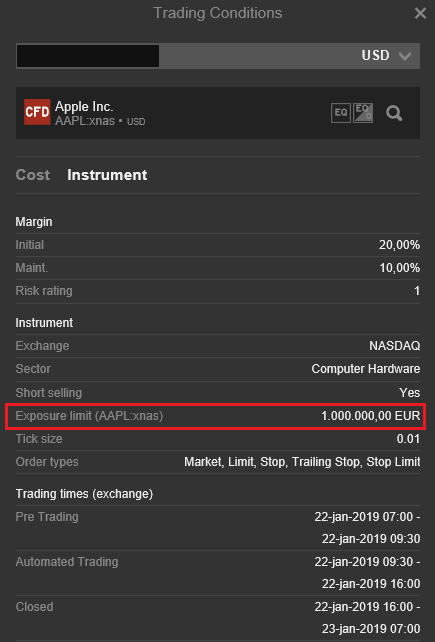

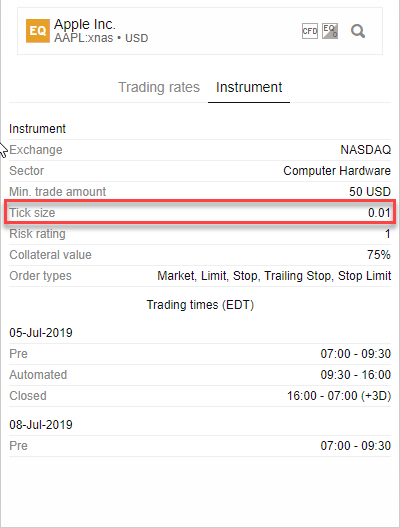

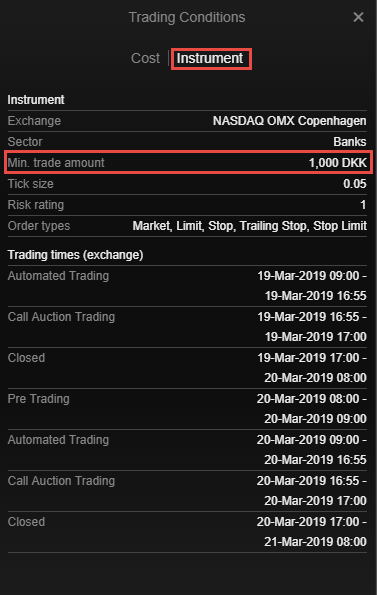

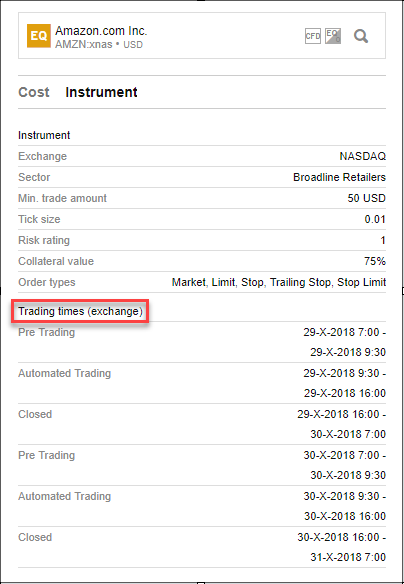

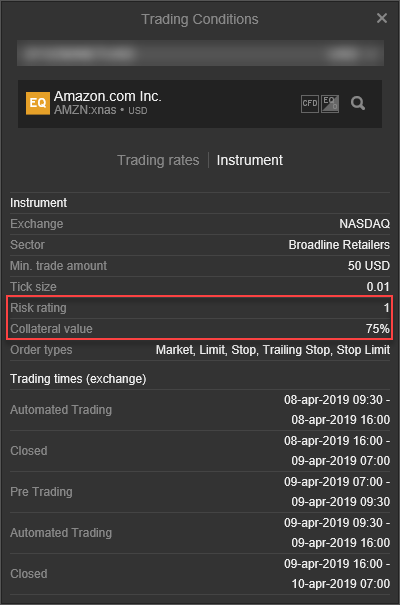

The Tick size is the minimum price movement of a trading instrument.

The price movements of different trading instruments vary with their tick sizes representing the minimum amount they can move up or down on the exchange.

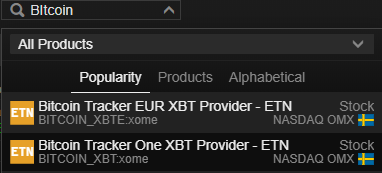

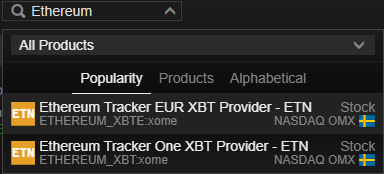

Sorry we couldn’t find anything

Clear Search

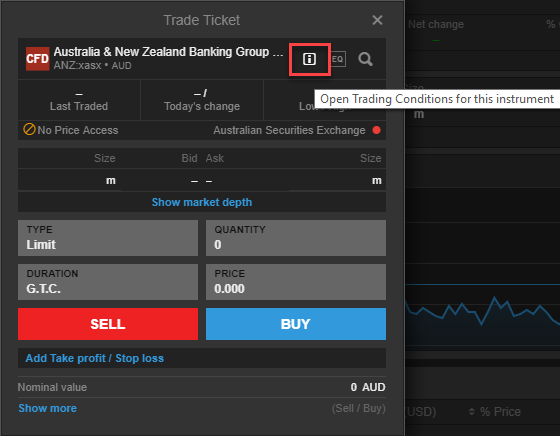

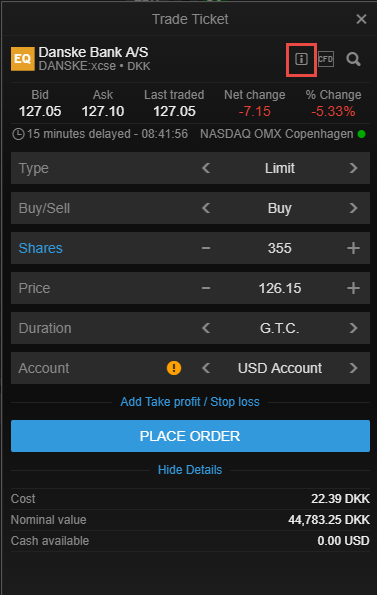

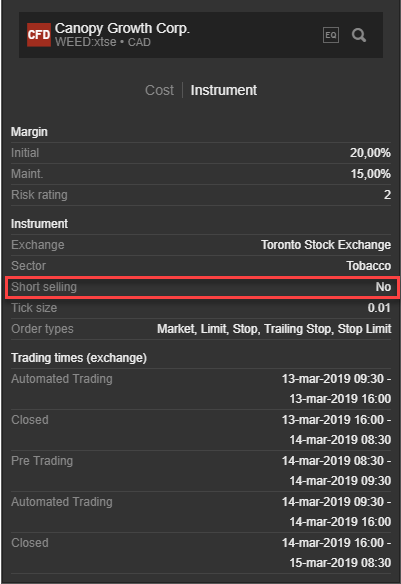

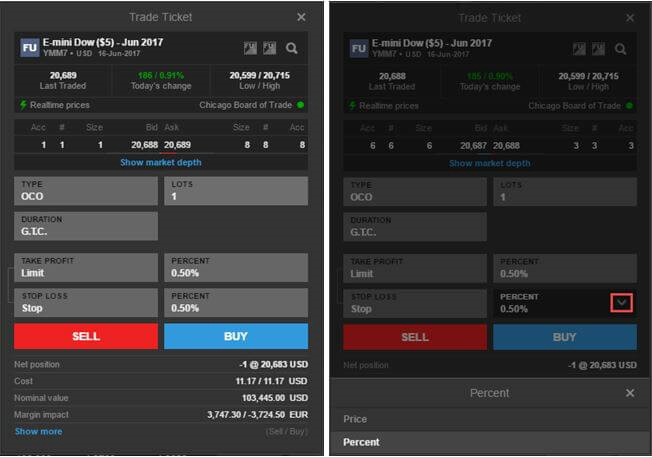

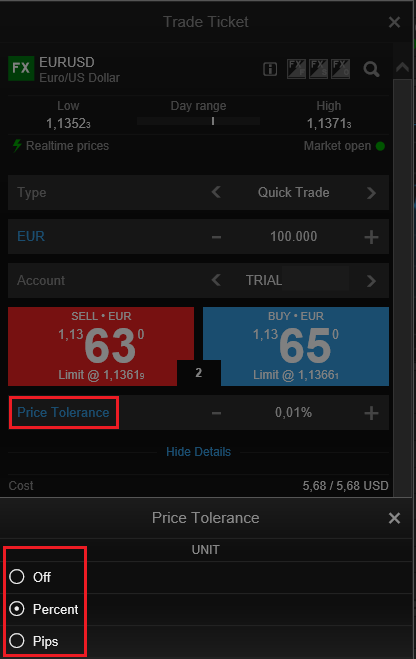

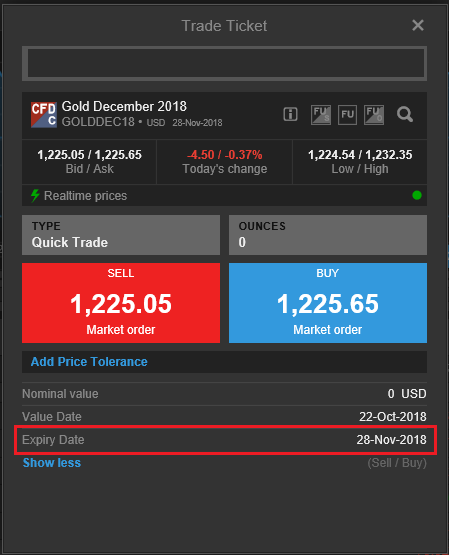

on the trade ticket or instrument overview (G&T Trader).

on the trade ticket or instrument overview (G&T Trader).