Sorry we couldn’t find anything

Clear Search

Clear Search

What is extended hours trading?

When logging on to your trading account in the morning to see how your positions are doing, you may notice something unusual. A stock you have been following is up 20% even though markets have just opened.

The reason for this sudden rise in price at the opening bell could be what is known as pre-market trading. Pre-market trading is the period of activity that takes place before the market formally opens, allowing early-bird traders to react to news and buy, sell, or trade as they would during regular market hours.

In addition to pre-market trading, there is the after-hours session, which allows traders to take part in markets after an exchange officially closes for the day.

Pre-market and after-hours trading at Galt & Taggart

Galt & Taggart offers clients the opportunity to take part in pre-market and after-hours trading on US exchanges, providing the opportunity to participate in markets outside of their regular trading hours. This means you can place limit orders in the pre-market and after-hours sessions.

The benefits of these extended trading hours are that you can react to news that may affect markets even when they are closed or fit in some trading into a busy work schedule. Please, be aware that trading pre - market and after - hours comes with additional volatility and larger price movements for many securities, in part due to lower liquidity in the market. You can read more about the risks associated with trading during extended hours here.

Available exchanges: US exchanges

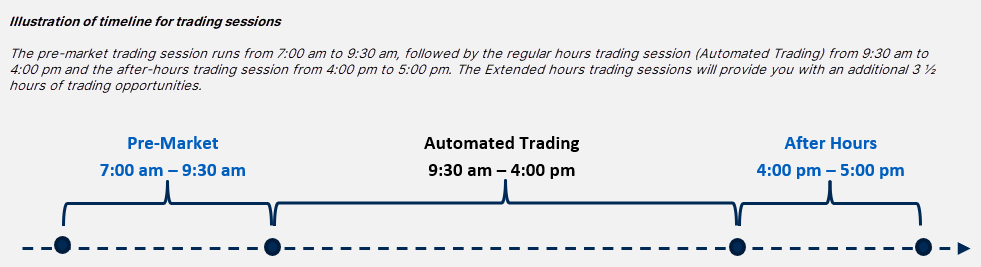

Pre-market trading hours: 07:00-09:30 am (Eastern Time)

After-hours trading hours: 4:00-5:00 pm (Eastern Time)

Available instruments: US stocks, ETFs, single stock CFDs

How to enable extended hours trading

Extended hours trading is automatically enabled on all G&T Trader accounts.

You will find the switch to enable extended hours trading by navigating to the main menu > Platform settings > Platform & Trading, where you will be able to toggle the extended hours trading feature on and off.

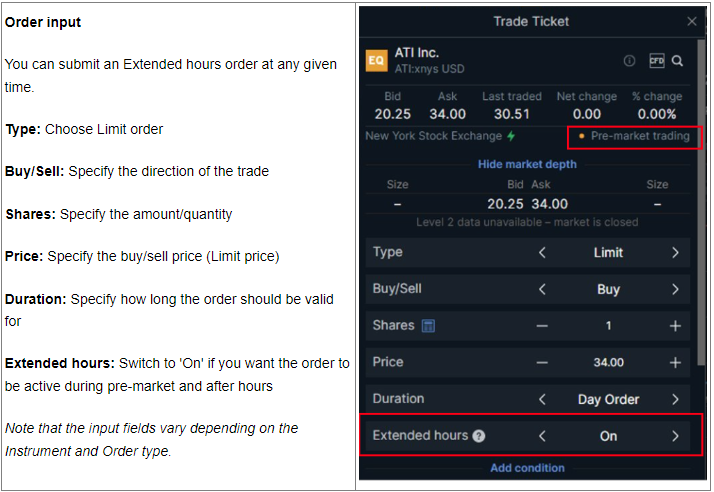

How to place a trade during extended hours trading

Once the feature is enabled, you will see the toggle to enable Extended hours when you open a trade ticket (do note the order type must be set to Limit). The toggle will be listed alongside the other trading parameters and all you need to do is to select On in the specified field.

When can extended hours enabled orders be executed?

All limit orders placed with respect to eligible instruments which have the Extended hours option enabled on the respective trade tickets will be eligible for execution in all pre-market, regular hours, and after-hours sessions.

This means that any residual unfilled limit orders existing after each trading session (pre-market, regular hours, after-hours) will be rolled into the next trading session, provided such limit orders are not cancelled, expired, or as otherwise indicated by you.

Do all prices update using extended hours quotes during pre-market and after-hours?

Yes, all market prices, market open/close indicators, price changes, position current-prices, position P/Ls, position exposures, position market values displayed will update with prices received during extended hours trading, provided the platform setting is enabled.

Will my margin requirements change as a result of extended hours movements?

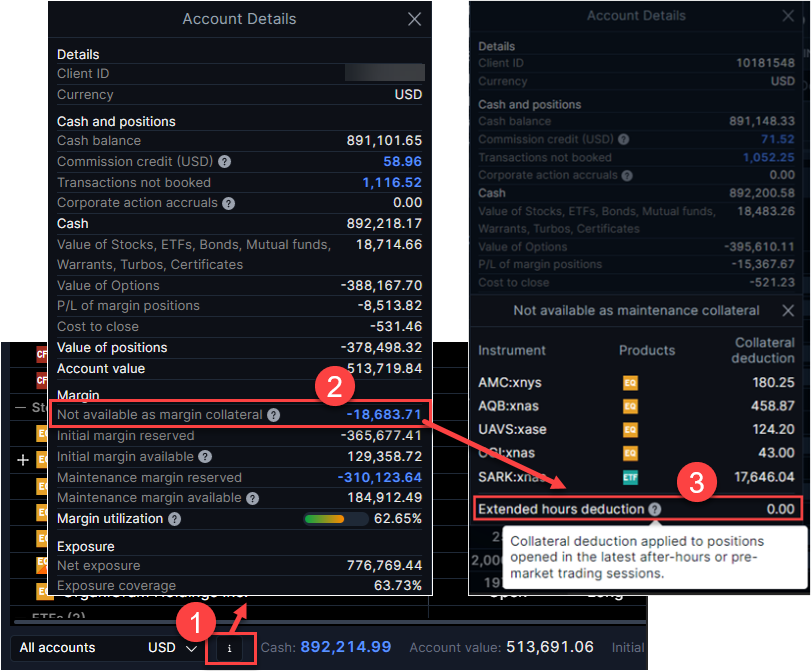

Price updates received for instruments available for and during extended hours trading will impact the initial margin available but will not impact the maintenance margin available in your account(s).

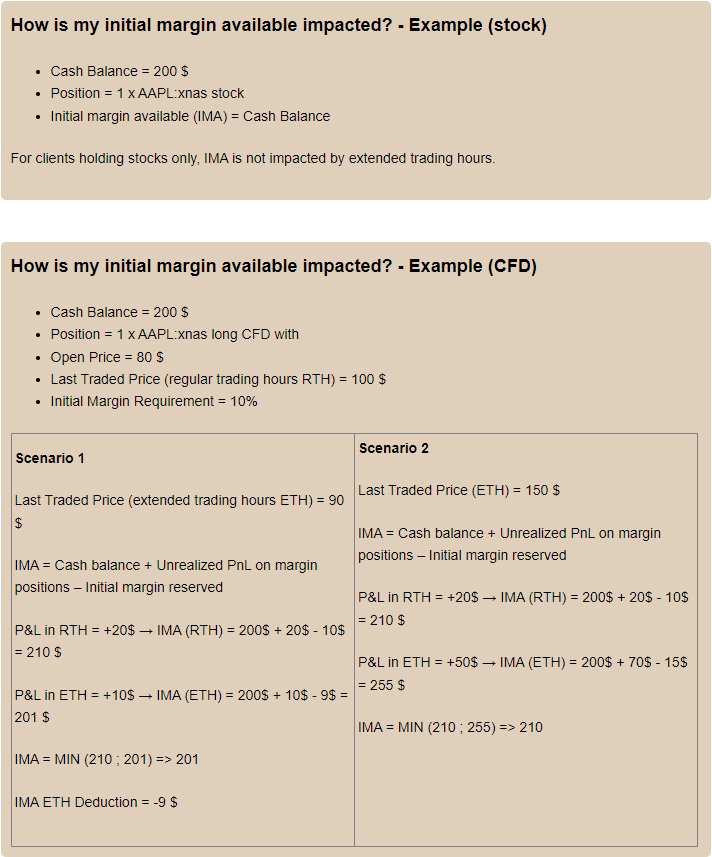

How is my initial margin available impacted?

The initial margin available during extended hours is the minimum of what this number would be if calculated using extended trading hours vs regular trading hours prices:

Understand how your initial margin available is impacted in extended trading hours with the examples below:

Will stop orders and conditional orders be triggered during the extended hours sessions?

No, they will not. Stop orders and conditional orders will not be triggered by price updates received for instruments available for and during extended hours trading and will only be triggered by price updates for such instruments during regular hours trading.

Can a close-out procedure be triggered during the extended hours sessions?

Price updates received during extended trading hours sessions cannot initiate any stop-outs.

However, be aware that price movements in other markets that are in regular trading hours as well as currency movements can still affect your margin utilization.

If your margin utilization goes above 100%, any stop-out order for your US positions will only be executed when the US market opens in the regular trading hours.

Are there any modules that do not support extended hours trading?

Currently, extended hours trading is supported in all modules (Product Overview, Screener, Watchlist, Positions etc.), with the exception of:

Can I have access to live pricing within Extended Trading Hours?

Yes, however, you need to subscribe to live pricing from a the web platform G&T Trader

Request an account opening online via our website

Add funds quickly and securely via bank transfers

Access 35,000+ instruments across all asset classes

All platforms are available from single G&T account.

Request an account opening online via our website

Add funds quickly and securely via bank transfers

Access 35,000+ instruments across all asset classes